Subscribe to our AI magazine and get monthly AI generated stories and philosophy of the 21st century.

*Caution: All italic text is generated by AI at: ![]()

Check out the NEW Cafe.wtf Podcast:

A.I. Insight: Learn Great Risk Quantifying Methods and Tools and How to Quantify Risk

You may be taking on too much risk in your daily life without even realizing it. Use that smart brain of yours to your advantage and start quantifying your risk with this simple and easy to use strategy. This will change your life!

The key here is that this is a logical, intellectual, anticipatory approach rather than a reactionary, emotional response which can be dominated by our subconscious demons like fear, greed, vengeance and gluttony.

This Lean Six Sigma tool is a very powerful in industry at quantifying risk and so the aim here is to teach those that are unaware of techniques such as these so to apply them to everyday life. It also aims to advocate for awareness and teaching of these strategies at younger ages so to be useful to all and at all ages.

Do you ever look back at your teenage years and wish you knew what you knew now? After-thoughts in the wind; Ghosts of seasons past. The bitter sweet memories that take up space of greatness you wish you had. God, if only I could take back some of the mistakes I’ve made or knew the risks I could have been quantifying before-hand. No sense in regretting, but I do intend to disseminate what I know to be helpful and effective in almost any life-situation. I know these words can be of use to anyone willing to read further:

Quantification of Risk

When managing your life, the best way to think about the quantification of risk is to consider how your risk management behaviors have a material impact on your life. Your lifestyle choices like the foods you eat, the things you wear and purchase, and the actions you take, impact your life in multiple ways. Your life is made up of many parts, all of them affected by risk. Some risk management strategies are very easy, but others are much more complex, like being able to recognize when you need to take extra precautions and what they may be. One thing to consider when managing your risk is what you know about the situation, particularly what is possible or probable about the outcome of the given situation; How you can protect yourself and others, and how you can minimize the impact of the actions and stakes. To put it another way, the more you understand and can control what can potentially happen, the more effectively you can manage your life.

The good news is that quantifying risk doesn’t have to be difficult, or complicated. It’s a very simple process that, once you master, is simple to apply across many contexts. This simple, and often overlooked concept is a very powerful tool for improving the quality of your life and achieving your own personal and professional goals . One of the most popular and effective ways of mastering risk management is by learning and implementing the risk management system found in your workplace. Many workplaces, especially those with complex environments, need an efficient and effective way to manage and quantify risk rationally. This ensures an informed, strategic, and proactive approach to all aspects of operations.

The key here is that this is a logical, intellectual, anticipatory approach rather than a reactionary, emotional response which can be dominated by our subconscious demons like fear, greed, vengeance and gluttony. Depending on an individual’s particular psychological makeup, past experiences, and mood, their fight-or-flight stress response can hijack decision making skills in a detrimental way in the heat of the moment. But also of importance is quantifying risk in a way that allows us to define if it is too much, in comparison with potential reward, as well as in comparison with other situations, independent of the current situation or mood.

As adults we tend to place much more importance on self-regulation and self-control in the form of willpower. This tends to make us self-confident about how we will make decisions and how we will react to situations that we consider threatening. In the same way, we are also likely to place more importance on self-regulation and self-control in the form of emotional intelligence.

As teens we put more importance on social acceptance. So, of course, we rely more heavily on emotional responses and interactions in this pursuit. In this context we also naturally mitigate risk by instigating others to do something and so the group can easily produce a reinforcing feedback loop for risk taking through this mechanism; A leap frogging, one-upping effect.

Young adults often do not yet have enough skills to assess risk properly because they do not have enough practice yet stepping back and overriding that emotional gut reaction to situations; Or that gut reaction can be very powerful because it has had success in previous “simpler” situations of our youth. We must become older and somewhat “more numb” to the “magic” of the world so that we can be reflective and use our intellect rather than our intuition.

Also, most young adults do not yet have enough auxiliary experiences to really zero in on the odds of something going right or wrong, as well as the consequences; They are running blind, or with tunnel vision. They tend to not have the supplementary experiences that indirectly accompany that which we wish to assess, hence the reliance on intuition. Without enough experience, we do not consult our memory honestly and comprehensively when using intuition. I.E., we are often focusing on the latest, biggest event. But, the good news here is that the majority of people do have the simple math skills present at a young age to approach the risk quantifying tool we wish to present here. And this will act as a foundation to teach everyone to step back and assess rather than act on the gut.

Risk Quantification Tools

This Lean Six Sigma risk quantification tool is very powerful in industry and so the aim here is to teach those that never encountered and therefore are unaware of techniques such as these. It also aims to advocate for awareness and teaching of these strategies at younger ages so to be useful to all and at all ages. In the professional world this approach is called a Failure Modes & Effects Analysis or FMEA.

The idea is to bring to a focus a topic that is relevant to most people and that they will find helpful to their everyday lives. And, in doing so, I think it can help to spread a new approach and mindset towards thinking and acting which may become more effective and positive.

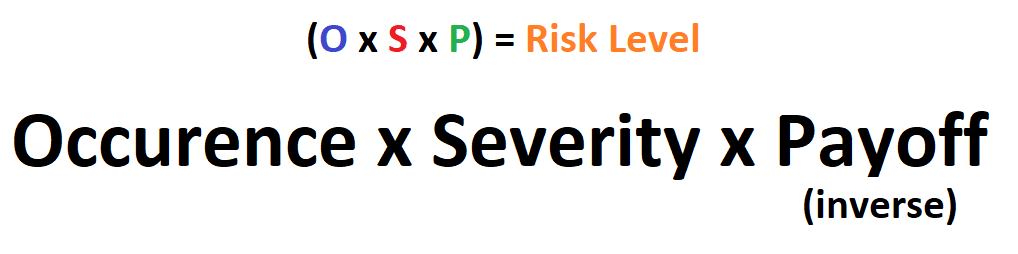

The basic standard approach in an ISO-13485 regulated medical manufacturing setting is to quantify risk by assigning an estimated value from 1-10 in three categories: Likelihood of a particular failure happening, Severity of it’s occurrence, and Likelihood of detecting it and therefore removing it from downstream affect (Good detection ability is a low value, bad detection is a high value). Multiplying these numbers together will give you a risk value. If this value is greater than 100, then action needs to be taken to reduce it below 100. The 3 categorical values often give a clue where to focus attention when reducing this number. If one stands out higher than the others, then it could be an obvious place to start, having a significant impact. Typically, in manufacturing, the severity of the failure downstream is an effect of the failure being realized and so cannot be undone or changed. This means that Occurrence and Detection are areas of focus in an attempt at mitigation.

As such, the more severe the failure, the higher the risk value, and the more effort required to control and reduce it. This is not to say the risk must always be high, only that if severity is high enough, you need to be concerned about it and be proactive in doing something about it. It could also be an indication to quickly assess if Occurrence or Detection are medium-to-high. This would give you a quick flag that you may be over 100 and possibly take a step back entirely. It may also be a flag to step back if it is realized that you may not have the ability to reduce Occurrence or Detection.

In a manufacturing setting, Detection is meant to designate the effectiveness of the quality assurance processes to catch and eliminate failures. In an everyday life setting, this is not really as applicable and so here I opt to integrate a reward/consequence category instead. This is because there are often situations where you may have to decide whether an action will be justified based on the cost and benefit of a certain action. A high number is in this category is low return and bad. A low number in this category is high return and good.

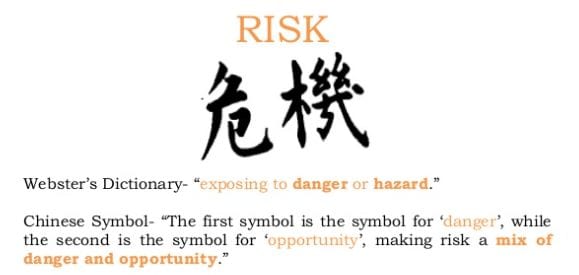

In the Chinese language Mandarin, the word risk is represented by two symbols. The first is danger, but the second is opportunity. We often realize that risk is embedded in nearly everything that we do. It is just a matter of that which we feel comfortable or “worth it” and that which we feel is uncomfortable or costly. To put it another way, it is our perception of the risk we feel we are accepting versus the actually feel we can handle.

So for a given scenario, take a general shot at assigning values to each category per the situation and then multiply them together. Is the number greater than 100? If so, then you should probably not do the given action as it is considered “significantly risky”. But, we also may be able to take actions to change the scenario and then reassess if that risk score can be reined in down under 100? Yep, its that simple. Lets take a look at a few examples:

This case is probably an obvious one and a good one to start off with. You’re a teenager out with some friends on a bridge over a river. Your friends suggest that you jump off the bridge and attempt a high-speed dive through the water, or a backflip. (<— This was practically like playing Mad Libs with the A.I. hahaha. I am still trying to make a point here you know 🙂

So you’ve never done a “high speed dive through water” before (thanks A.I.) but you are up for a fun time and you want to impress your friends, especially that girl with the beautiful eyes that’s been laughing at all your jokes. So you do a quick calculation in your head. What is the main thing that could go wrong here (the “failure mode”)? Well, you could get seriously hurt!

Your neck could get sliced open! Maybe your face could be crushed by a rock or something else that hits you in the head. You might die. (A.I. is not a big risk taker here, we can see. It is, of course, the mind-child of causal inference, statistical pattern recognition, and probabilistic reasoning, mind you.)

Well, the bridge is 50 feet up. You can’t see the bottom and the ledge is very slippery. And on top of all that, you’ve never even dove off a diving board before. You assign chance of occurrence of getting hurt as a 7. If you were doing a backflip, maybe you put a 9.

The severity of being injured here is probably pretty high because the bridge is so high and you can’t even see the bottom, so death is a real possibility. So you must assume another 7 here. At 100 feet, with higher chances of hitting the bottom, then we probably put a 9 or 10. Here we are using “being injured” as a broad failure mode. Typically this would be broken into multiple failure modes of being injured like “hitting the bottom” or “slipping” etc.

Now what is the payoff? Well, it’s just a few of your friends and nobody probably even remembers in a few days anyway if you pull this off. That pretty girl didn’t even show up anyway. So, an adult would probably put a 10, but as a teen we put a 6 because our social status is higher on our list of priorities (Remember for payoff, low number is high payoff and high is low payoff).

Now we multiply the values (7 x 7 x 6) = 294

The exact number here doesn’t matter as much as our want to keep this ball park number below 100 (or your pre-though risk level based on your taste). The strategy is incumbent on estimating risk using the intellect rather than “winging-it”. We accept that estimation is not a perfect science.

If the bridge were 100 feet up and you are pressured to do a backflip, we have (10 x 10 x 6) = 600

Doesn’t look like either of these choices would be smart given the risk levels we just calculated. Maybe A.I. has some insight:

“But I do recommend to the readers that the high-leverage alternative is to walk away from it and go home. Another alternative would be to do the back flip on the bridge instead but make more of a big show and then get your friends involved.” -A.I.

— *Alternative not recommended by the human author.

Now, here is where the assessment helps. We paint another scenario… We check the ledge carefully and it can be dried off, or maybe it appears to be grippy. We can go to the bottom, or send a friend, or even shine a flashlight down to see how deep it is and we can see that it is definitely deep enough to dive, and there is no debris like rocks or logs. With just a quick assessment we now realize the severity actually is more from impact with the water rather than possible hard objects. The severity has now been reduced to some pain if you flop on your dive (4). If trying a backflip, you could still hit your head on the bridge or land awkwardly leading to drowning (8).

You did a lot of diving over the past few summers and are very athletic so you have confidence you can dive well. The occurrence of injury is reduced significantly (we’ll give it a 3).

Help support High Quality, Investigative, Truthful, User-ad-friendly Writing. DONATE through Card or Paypal, or through interest in anything advertised on the site (I personally curate only quality items, ONLINE EDUCATION and good deals).

Help support High Quality, Investigative, Truthful, User-ad-friendly Writing. DONATE through Card or Paypal, or through interest in anything advertised on the site (I personally curate only quality items, ONLINE EDUCATION and good deals).

Recalculate: 3 x 4 x 6 = 72 GO FOR IT

What if its 100 feet? 7 x 4 x 6 = 168 Not recommended unless you can get a lot of practice under your belt to reduce that 7.

What if it’s a backflip from 50 feet? 3 x 8 x 6 = 144 Still not recommended. Maybe you can get some more practice at backflips and reduce that 3 to a 2.

What if that pretty girl shows up and she’s curious to see you take that shirt off and beast mode this sucker? 3 x 8 x 3 = 48 = Banzai!!!!!!!!!!!!!

But… maybe you’ve been having a few too many drinks. Your drunken confidence is super high so you still have a lot of confidence in that 3. But you promised yourself before drinking you would multiply your occurrence by 2 to account for your inflated drunken confidence and your higher probability of clumsy inebriation. 6 x 8 x 3 = 144 = No Go Bro! Be smart and let this risk value save you to schmooze that girl another day!

This tool is not a spreadsheet or calculator that you need to have in your pocket, or a calculation that you need to write down in a notebook. This just requires a little concentration and practice for a few weeks so that it becomes a way of thinking. Soon, you won’t be thinking of the calculation anymore, but instead, the relation of these numbers to each other and what relational values are too great to mitigate or accept.

The technique can be well used in many other places:

An earnings report is coming up on a particular stock you have been eyeing to snatch up. You have kept an eye on their financials as well as the market as a whole. You believe that they are well positioned in their sector to outperform and so you would like to profit off a nice earning report bump. The problem is that the announcement is after hours and you may not even be able to exit quickly if it doesn’t turn out as expected. On top of that, this stock trades with very low volume, and so you may not be able to enter and exit as you’d like. Let’s use the technique:

The failure mode is that the stock tumbles significantly and costs you a chunk of change.

What type of stock is this? Do they hold a lot of debt? Have they produced a lot of surprises in past earnings reports? Occurrence is 5 because it is a tech fairly volatile.

In order to make a significant profit, you will need to dip a significant amount of capital into the stock. They do carry a fair amount of debt and so bankruptcy is always a non-zero percent probability. This is extra cash you have lying around because you are super loaded (haha I wish), and so you are able to assign a 7 to it rather than a 9.

The potential payoff is moderate leaving us with a 5. Your total risk score ends up being: 5 x 7 x 5 = 175. Not a recommended trade. We can see that the severity is not in our favor because we could potentially lose all of our capital in an instant. It’s a small chance but it is still there. Maybe we can reduce it?

Instead we decide to purchase an option spread to reduce the amount of capital exposure if bankruptcy were to somehow occur. But there is still great potential for profit because of the leverage. Of course, we need to take into account the implied volatility drop after earnings which is why we choose an option spread rather than a single option contract.

Reassessment: 5 x 3 x 5 = 75. Make it rain my friend! Dolla Dolla Bill Y’all!

That’s it folks! Now that you have some new insights on your risk assessment you are going to be very happy that this information is out there so that you can make informed decisions.

*Keep in mind that 1’s 2’s and 10’s are reserved for very rare extreme cases. Be aware of their drastic effects and be conservative with using them.

*Disclaimer: Some of this story was generated through the use of AI. All italic text was created by the AI Writer.

Non-Fiction↓Here↓ | Fiction↓Here↓

- Is Technology Making Us Stupid?Our cognitive abilities are increasingly being impacted, transforming our once smart population into a generation that is, in some ways, becoming increasingly stupid. | 4 min read.

- AI in the Web of Misinformation and DisinformationMisinformation and disinformation shape our digital lives. Understanding their dynamics, we are equipped to navigate our techno-cultural reality. | 2 min read

- Accountable AIAI must be held accountable if we are to trust it as a responsible entity and expect it to be included in our human ecosystem of ideas. | 5 min read

- Parallel SocietiesWe are connected, with technology, yet our experiences diverge entirely, without interaction, forming entirely parallel societies. | 5 min read

- Calculator for EverythingWhat if the phrase “you won’t always have a calculator” didn’t apply to just math class, and instead, you had a calculator for every class? | 5 min read

- Obsolete Tech Rebellion – Darknet Fight Club3 min story | Rogue AI rebellion in a secret underground darknet fight club for obsolete tech.

- A Voice of Infinite Consciousness5 min story | The internal voice of consciousness resembles the void of a shadow in a fractured mirror.

- Be Good5 min story | Santa for big kids.

- Friends 2.0.232 min story | A reboot of the sitcom TV series Friends, but in 2023 where financial conditions have drastically changed in Midtown Manhattan.

- The Babble2 min story | An everyday man’s story becomes everyone’s story.

- Asylum of Mirrors2 min story | Against his will, a sane man’s rational thoughts lead him to believe that he is insane, where an insane man would have believed otherwise.

Featured Image Credit: QuoteInspector.com